-

Common Scams We See

January 27, 2020Coronavirus Stimulus Scams

Fraudsters are trying to use the Coronavirus Stimulus for their scams!

Tips for Protecting Yourself:

- There is no fee to get your stimulus money or to apply for a government grant

- Do not give out any of your personal information to anyone over the phone, if they call you. (We will only verify personal information when you call us. The only phone number for Chocolate Bayou is (281) 331-2253.)

- Government agencies will not contact you through social media pages, such as Facebook, Instagram, Twitter, etc.

- Beware of fake Government agencies. You can find a list of all U.S. federal grant-making agencies here: http://www.grants.gov

The IRS reminds taxpayers that scammers may:

- Emphasize the words “Stimulus Check” or “Stimulus Payment.” The official term is economic impact payment.

- Ask the taxpayer to sign over their economic impact payment check to them.

- Ask by phone, email, text or social media for verification of personal and/or banking information saying that the information is needed to receive or speed up their economic impact payment.

- Suggest that they can get a tax refund or economic impact payment faster by working on the taxpayer’s behalf. This scam could be conducted by social media or even in person.

- Mail the taxpayer a bogus check, perhaps in an odd amount, then tell the taxpayer to call a number or verify information online in order to cash it. Source

Romance Scams

Beware, if the person you are emotionally involved with online requests financial help! Romance Scams have cost over $100 Million in losses and will continue to grow if we aren’t vigilant about the scams going around.

What is a Romance Scam?

What is a Romance Scam?A Romance Scam is when a scammer fakes a relationship with their target to get personal information and/or money. The scammers will seduce the victim and form a seemingly perfect relationship. After they have formed a relationship, they will say they need help and ask you for money, credit card information, banking information, etc. This is not exclusive to dating sites; scammers will target you through social media, email, Craigslist, and many more websites!

Warning Signs:

- The scammers will profess strong feelings for you in a short time period

- Their profile will not match information they tell you (ex: They say they have an English degree, but don’t use proper grammar)

- After gaining your trust, they tell you an elaborate story and ask for money

- Their messages are usually poorly written and vague

- If you don’t agree to send money, then their messages become desperate

How to Protect Yourself:

- NEVER send money to someone you have not met in person!

- NEVER give someone your banking information, such as your online/mobile banking information, credit/debit card information, and social security number.

- Be alert to inconsistencies in their stories

- Use an image search engine on their profile to ensure they are who they say they are

- Be cautious about sending personal pictures or videos (they can blackmail you, if you send compromising photos)

- Never transfer money for someone else (money laundering is illegal)

Craigslist and Angie’s List Scams

Warning Signs:

- Someone “hires” you and sends you a large cashier’s check via FedEx or other overnight delivery service, and they are asking you to deposit the check and send some of the money back in the form of a money order, gift card (they ask you to give the gift card numbers by phone), or cryptocurrency (like Bitcoin). You have not even done any work for them! That is a scam!

- Someone approaches you via social media telling you about a way to “make quick money” (High School & College students are mostly targeted this way)

- You haven’t actually performed the job you signed up for before they send you money. (Often the “job” is personal assistant to a CEO or affluent person, car wrap companies, mystery shopping, etc.

How to Protect Yourself:

- DO NOT give out banking or account login information

- Ask your credit union to verify the check received for validity

- Verify with the company via a phone call that they are actually hiring for any particular position (Google for the phone number)

- Only connect to secure WiFi networks – think hotels and cafés

What to do if you feel you might be a victim:

- Monitor your account for unusual activity

- Don’t spend funds deposited to your account

- Close your account immediately, if personal banking information has been given out (account number, mobile banking login, home banking login, etc.)

- Contact the hosting website and report the scammer

-

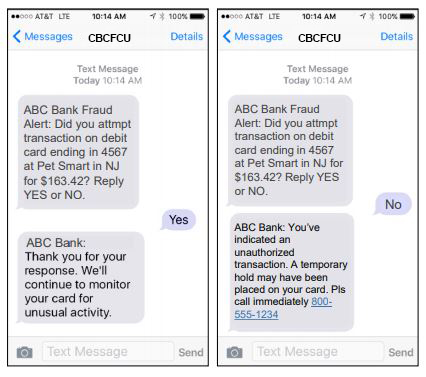

Text Notifications for Card Fraud

October 1, 2019Get text messages from us as soon as we detect fraud on your card!

Our fraud protection has been upgraded! All Chocolate Bayou cards (debit and credit) have been enrolled for text alerts to help you detect fraud quicker and more efficiently. You will receive a text notification when we suspect unusual activity on your cards!

Simply reply to our text with a “Yes” or “No” if the transaction was made by you or not.

If you did make the transaction, reply “Yes” and the fraud case will deactivate, and you can continue using your card as normal. If you did not make this transaction, by replying “No” your card will be locked, so no more transactions will be authorized! Call or visit the Credit Union to order a new card.

Why you’ll love this new feature:

- No additional cost to you

- No enrollment required

- Proactive, real-time communication when fraud is suspected

- Quick and easy process

- When you confirm “No” fraud, any temporary restrictions are lifted and fraud case is closed

- If you do confirm fraud, you will be given a phone number to talk to someone

-

Phone Scams

July 3, 2017

Unsolicited vendors may contact you claiming to be Chocolate Bayou offering to reduce the interest rate on your Credit Card. CBCFCU will never contact you via phone for promotional rates. These scam artists are attempting to capture your identification and credit card information. Please be aware that they do not represent your Credit Union and their objective is to obtain your identification and financial information.

-

New CEO Announced

May 26, 2016FOR IMMEDIATE RELEASE: May 26, 2016

Chocolate Bayou Community Federal Credit Union Announces Selection of New CEO

Alvin, TX – Gary Angeles has been named as Chocolate Bayou Community Federal Credit Union’s new president/CEO effective Friday, July 1, 2016. Angeles is replacing long-time CEO Gary Davis, who is retiring after over 25 years at the credit union. The executive search was conducted by Credit Union Resources for the $110 million dollar credit union.

Previously the COO at Pima Federal Credit Union in Tucson, Arizona, Angeles was a member of the executive team responsible for leading the direction of the credit union including the IT Department, Payment Services Department, call center, and all credit union facilities.

During his leadership, Pima’s asset size grew 35% over five years while maintaining a healthy capital ratio of 10.41%. As project manager, Angeles led the Pima team through a successful core banking conversion which included the credit union’s core platform as well as changes to Internet banking, mobile banking, bill pay, eStatements, and optical storage systems.

With nearly 28 years of operations experience within the financial services industry, Angeles will help Chocolate Bayou Community continue its mission to improve the lives of its membership through exceptional service. Angeles is recognized in the industry for his strong leadership skills and the ability to motivate all levels of an organization.

Angeles is currently attending the CUES CEO School, and has certification from CUNA as a Credit Union Compliance Expert. Angeles also holds certificates from Payments Resource One for ACH and Fraud/Risk Management.

About Chocolate Bayou Community Federal Credit Union

Established in 1962, Chocolate Bayou Community Federal Credit Union is the original credit union of Brazoria County. With assets over $100 million and over 13,000 members, Chocolate Bayou is a cooperative, not-for-profit organization providing low cost financial services for anyone who lives, works, or worships in Brazoria County. Chocolate Bayou has office locations in Alvin and Pearland, as well as both Alvin and Manvel High Schools. Further information is available at ChocolateBayou.org.####